Recruitment Market Update 2024 – Middle East

Welcome to Barclay Simpson’s Market Update, which provides an overview of risk, governance and controls trends from the Middle East recruitment market in 2024.

Market Overview

Recruitment activity in risk, governance and control-related functions has been broadly flat across the Middle East throughout 2024, and this continues to be the case as we head further into Q4.

While many economies worldwide experienced a post-pandemic bounce in hiring after the peak of Covid-19 had passed, we are yet to see a similar pattern emerge in the Middle East. Indeed, contrary to some media reports of strong hiring demand, the region’s employers remain cautious on the whole.

A number of markets are bucking these broader trends, however. For example, digitisation programmes and the development of tech-driven services in financial services have led to elevated hiring in these areas. There has also been increased demand for candidates in the liquidity risk space among a range of firms, including consultancies, banks, sovereign wealth funds (SWFs), brokerages and fintechs.

Outside of the financial services industry, large-scale state-driven transformation projects have gained momentum, creating significant activity in the health and education sectors across the region. At a national level, Saudi Arabia and the UAE remain the busiest hiring markets overall, although much of this recruitment activity is replacement hiring, with expansionary plans somewhat subdued.

Looking ahead, we are nevertheless optimistic for the Middle East recruitment outlook in the latter half of this year and beyond. Many organisations appear to be delaying hiring decisions until the economic and political backdrop becomes clearer, both domestically and abroad. The resolution of several key leadership elections, including in the US and the UK, as well as a potential drop in regional interest rates, is likely to kickstart hiring demand over the coming months.

Multiple countries within the region also have comprehensive economic development plans in motion, which aim to drive growth and boost Middle East jobs by 2030. All of these factors point to increased hiring in 2025.

Key trends in Middle East recruitment

Employer expectations high

We are seeing more professionals express an interest in relocating to the Middle East, citing the lifestyle, remuneration and a lack of opportunities in their local markets as key motivations for making a change.

As a result, there is certainly no shortage of candidates in the market. However, the region’s employers are discerning; they are seeking people who have a strong work record, key skillsets and a desire to build a long-term career in the Middle East.

Finding the right talent can therefore take time. In fact, recruitment processes have been noticeably slower over the last year, as employers show an abundance of caution during a period of widespread candidate availability and uncertain market conditions.

Some countries have also implemented strict nationalisation targets, which means employers are required to hire a minimum number of employees from local talent pools. For example, in Saudi Arabia, employing foreign candidates in a profession or activity that is reserved for a Saudi national can result in fines. Despite this, ongoing skills shortages in key areas mean demand remains high for certain senior professionals, particularly those in specialist risk jobs and technology or data-related roles.

A new era for contracting?

Participating in the Middle East contracting market has traditionally been challenging for UK professionals because of the difficulty of obtaining a short-term visa in many countries. But this could be about to change, as some countries in the region are updating their freelance and temporary work visa schemes.

For instance, the Dubai Freelance Visa – launched earlier this year – reduces some of the barriers that interim workers have previously faced when pursuing contract jobs in the emirate. Most notably, freelancers can reside and work in Dubai without the need for a local sponsor.

Saudi Arabia also launched a new Temporary Work Visa in 2023, which has loosened restrictions on the types of profession cleared to work short term in the country. The visa is valid for one year from the date of issuance and allows foreign contractors to stay in the country for up to 90 days, with a possible 90-day extension. Multiple entries in and out of the country are permitted.

Active hiring in SWFs and fintechs

Collectively, SWFs across the Middle East manage nearly $4 trillion of assets. In fact, the Middle East dominates the SWF rankings, with the UAE, Saudi Arabia, Kuwait and Qatar all appearing in the top 12 in terms of AUM, according to Reuters.

Middle Eastern funds invest heavily overseas, and thus they are eager to recruit skilled international professionals from across the global funds industry. Our consultants are therefore reporting rising demand for investment risk, compliance, and data analysis professionals as SWFs become more sophisticated and grow out their teams.

Meanwhile, regional fintech growth has also been strong, with McKinsey & Company estimating that investment in the sector across the Middle East, North Africa and Pakistan (MENAP) could increase three-fold from $1.5 billion in 2022 to $4.5 billion in 2025.

Due to the rise in fintech and fintech-related businesses launching throughout the region, we are seeing a small, but steady increase in demand for governance-related roles, particularly within compliance. We expect hiring to become more active as these fintechs grow in size and ambition.

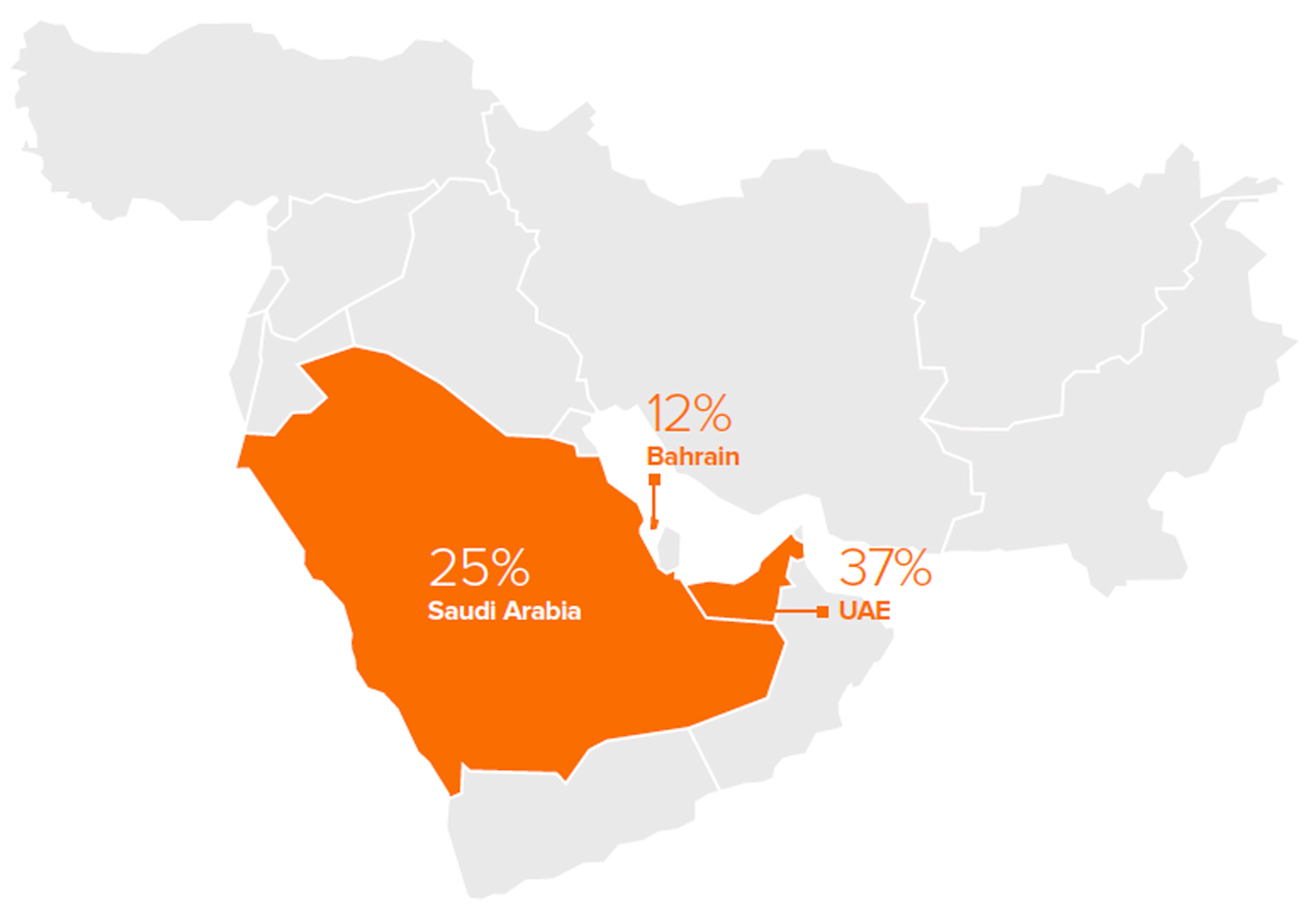

Fintech funding by country

Source: McKinsey & Company

Salary trends in the Middle East

An oversupply of candidates in the market has led to salary inflation remaining relatively low across the Middle East in 2024. Nevertheless, successful candidates can still expect generous remuneration packages that compare favourably to the UK.

In addition to receiving substantial work-related benefits at most organisations, such as extensive medical care and schooling support, employees also benefit from lower taxes, cheaper fuel and savings on private education for their children.

While professionals don’t receive pension benefits, foreign nationals are usually entitled to an end-of-service gratuity payment at the end of their employment in most countries. Overall, the region remains an attractive location for professionals who wish to further their career and enjoy an excellent quality of life.

Attract and retain the risk, governance and controls professionals you need in the Middle East with Barclay Simpson.

View or Download PDF Version of the Report below:

If you are interested in a new Middle East position or recruitment services, get in touch today.

Home

Home

Jobs

Jobs

Upload CV

Upload CV

Find Talent

Find Talent

Careers

Careers