Recruitment Market Update 2024 – Risk & Quants

Welcome to Barclay Simpson’s 2024 Recruitment Market Update, which provides an overview of current recruitment trends and insights across the risk management and quantitative risk sectors.

Market Overview

Across all the areas of risk that we cover, hiring was relatively subdued in the first half of 2024, despite a few periods of elevated activity, particularly in Q2. However, opportunities in quants, commodities, distressed credit and non-financial risk have provided some relief from a challenging market overall.

While the run-up to the General Election was undoubtedly a contributory factor, slow global growth, persistent inflation and high interest rates have had a more direct effect on risk jobs. And while the financial system seems to be healthy with well-capitalised banks, costs have escalated post-COVID, with revenue growth hard to come by.

This has led to various measures to reduce costs, including redundancies, hiring freezes, the off- and near-shoring of roles, and consolidation, especially in the retail banking sector. Despite these challenges, we maintain a positive outlook for risk recruitment.

As departments become increasingly under-resourced, underlying demand continues to steadily increase. In other words, the worst seems to be behind us, and we anticipate an increase in activity in 2025. Our optimism for the coming months is also bolstered by the prospect of a more stable political environment, the early green shoots of economic recovery and interest rates likely coming down from their peak.

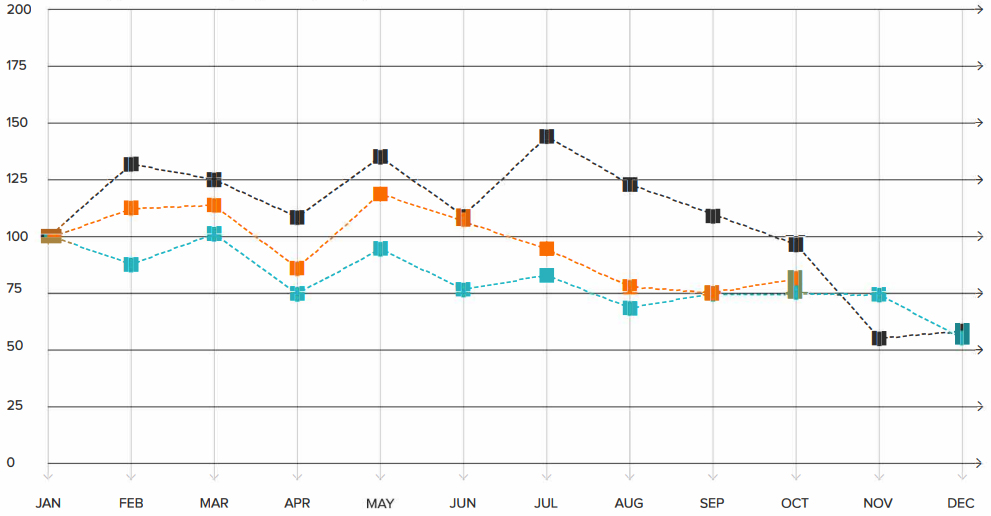

Risk Management & Quants activity index

Source: Barclay Simpson – in-house recruitment activity data indicating the pace of the market.

.

Supply of risk & quant jobs

Key trends in risk recruitment in 2024

Pricing quants in high demand

The market for pricing quants remains highly competitive, with firms in both the sell side and buy side raising base salaries and offering substantial bonuses to attract and retain talent. We expect this trend to continue in 2025.

As financial institutions continue to automate and digitise pricing models, there is also growing demand for quants who can bridge traditional mathematical techniques with modern tech skills. Professionals with expertise in emerging technologies like machine learning, Al and blockchain are especially desirable.

And while quant jobs have traditionally been office-based, post-pandemic hybrid and remote working policies have become a significant draw for good candidates. Similarly, we are also seeing a reverse shift from the buy side back to the sell side in pursuit of a better work-life balance.

The credit risk cycle

Thames Water has been in the media spotlight recently due to its debt levels and refinancing issues. The utility company’s woes are likely just the tip of the credit risk iceberg. Companies that enjoyed debt at a low cost before the pandemic now need refinancing in a much higher-cost environment.

This situation is a consequence of the usual credit cycle, whereby commercial debt increases in periods of low interest rates until it forms a bubble. However, the steps taken to shore up the economy during the pandemic have delayed the bursting of the bubble, while steep increases in interest rates to tackle inflation have only compounded the problem.

Artificial intelligence gains momentum

The potential for Al deployment is vast in risk, ranging from retail fraud detection through to trader conduct monitoring and complex modelling. Indeed, Al and machine learning technologies are already extensively used in risk functions, most notably in less complex, low-value and high-volume tasks, such as retail credit processing and flow commercial credit applications.

While people currently employed in these areas are being replaced by automation, Al deployment also creates new credit risk job opportunities due to oversight and governance issues. This leads to new roles that extend the concept of model validation to model and Al governance, as it becomes necessary to determine how, why and where Al can be utilised, as well as how its use in the business is being monitored and governed.

A snapshot of risk markets

Credit risk

The growth of private debt over the past decade shows no sign of slowing down. Pressure on the UK chancellor Rachel Reeves from the pensions industry to redefine the key debt measure could see an acceleration in the growth of real assets within the private credit sector. This, in turn, will drive further demand for candidates with experience of real assets – particularly infrastructure – from pension funds and other buy-side investors.

Meanwhile, the development of the credit risk cycle, as outlined on the previous page, could have a significant impact on recruitment. The most obvious outcome is an increase in demand for individuals with experience of managing credit risk through a downturn, as companies seek to refinance in a more challenging interest rate environment.

Market risk

Over the past few years, the hiring landscape for market risk jobs has been relatively quiet. Nevertheless, we have seen a noticeable uptick in the last six months, primarily driven by the commodities sector. In this space, both commodity trading firms and hedge funds have been actively recruiting talent from banks, leading to a need to backfill these roles. This has created a chain effect where candidates move between firms within the same function.

In some cases, demand has expanded to include candidates without specific commodities expertise, thereby organically growing the talent pool. However, this high pace of hiring is not expected to continue at the same rate over the next six months. Hiring across other asset classes has remained comparatively subdued, with sporadic recruitment mainly occurring to replace departing staff.

Investment risk

The demand for investment risk roles remains broadly flat, with minimal hiring activity and limited movement. Recently, three large asset managers announced redundancies, including the departure of two Heads of Investment Risk. While these restructurings may create more demand next year, the market overall is expected to maintain a steady but limited flow of new positions across all levels.

That said, a significant number of senior candidates are currently interested in exploring new opportunities. If even a few begin moving roles, this could trigger a surge in vacancies by mid-next year. This potential shift could be linked to the typical 3-5 year tenure that is common in such roles, coupled with the fact that the last major hiring wave for investment risk jobs occurred around three years ago.

Operational & Enterprise Risk

Operational risk and enterprise risk functions continue to hire across various industries at all levels. Growth is particularly strong in sectors outside of financial services, such as pharmaceuticals, utilities and telecommunications, where risk practices have historically been slower to develop.

In contrast, there has been less organic growth within the financial services industry. Many well-established companies are opting not to replace senior-level staff when they leave, instead choosing to either hire at a more junior level or leave positions unfilled.

Despite the limited number of open roles, there is a high level of interest from candidates exploring new job opportunities. This is especially true at the mid-level of the market, although there is less activity at the junior and senior levels.

Quantitative/Model Risk

While quantitative risk has been reasonably quiet over the past six months, the need for hiring is gradually increasing, primarily driven by regulatory requirements such as Basel 3.1 and SS 1/23.

Basel 3.1 has had a significant impact on hiring trends within the banking sector, influencing roles in risk management, regulatory compliance and quantitative analysis. The regulation, which aims to enhance capital requirements and risk frameworks, has led to growing demand for professionals who can navigate its complexities, especially in the areas of model risk, model governance and credit risk modelling.

Despite this demand, many firms currently lack the budget or necessary approvals to proceed with hiring. However, 2025 is expected to be a busier year, with increased activity anticipated in both model risk and model governance.

Asset Management in Europe

Hiring appetite among European asset managers has been lower over the last six months, but this is expected to change in the coming months. The demand for talent – particularly in operational risk – is rising, driven by regulations such as DORA and Solvency II. Additionally, ESG remains a key priority, with firms seeking candidates skilled in stress testing and scenario analysis, especially in Luxembourg, which has seen more activity than other regions.

Employers’ urgency to hire also appears to be increasing, likely due to the need to fill positions before the end of the year to align with the 2024 Budget. Looking ahead to next year, clients indicate they have hiring budgets in place, suggesting a positive outlook for 2025.

Salary trends in Risk & Quants

Given the overall tenor of the recruitment markets in 2024, as well as the significant wage inflation of the previous three years, it will come as no surprise that salary levels have remained comparatively flat.

Nevertheless, earnings have started to outpace inflation, with salary levels for those remaining at their current employer averaging around 5-7%. For those seeking opportunities elsewhere, salary increases in the range of 10-20% are available, but typically 10-12% is the most likely outcome across most markets.

Retail Banking – Credit Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Junior Analyst (0-12 mths) | £40k – £45k | £35k – £40k | £30k – £35k | £200 – £250 |

| Analyst (2-3 yrs) | £45k – £55k | £40k – £55k | £35k – £40k | £250 – £350 |

| Senior Analyst (3-6 yrs) | £55k – £70k | £55k – £70k | £40k – £60k | £300 – £450 |

| Manager (6-9 yrs) | £70k – £85k | £70k – £85k | £60k – £75k | £500 – £600 |

| Senior Manager (9-12 yrs) | £85k – £100k | £85k – £100k | £75k – £90k | £650 – £750 |

| Director (12+ yrs) | £100k – £120k | £100k – £130k | £90k – £110k | £700 – £800 |

| Head of Credit Risk | £120k+ | £120k+ | £110k+ | £800+ |

Retail Banking – Operational Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Analyst | £40k – £60k | £40k – £60k | £35k – £45k | £200 – £350 |

| Manager | £60k – £90k | £60k – £90k | £50k – £75k | £400 – £500 |

| Senior Manager | £70k – £110k | £70k – £110k | £65k – £90k | £450 – £600 |

| Director | £100k – £140k | £100k – £140k | £85k – £110k | £600 – £750 |

| Head of Operational Risk | £125k+ | £125+ | £100k+ | £700 – £850 |

Corporate Banking – Credit Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Graduate / Junior Analyst (0-12 mths) | £40k – £45k | £40k – £45k | £40k – £45k | £200 – £250 |

| Analyst (2-3 yrs) | £45k – £60k | £45k – £60k | £35k – £45k | £200 – £300 |

| Associate Vice President (3-6 yrs) | £60k – £85k | £60k – £85k | £40k – £60k | £250 – £400 |

| Vice President (6-9 yrs) | £90k – £130k | £90k – £130 | £80k – £110k | £450 – £550 |

| Director (10+ yrs) | £130k – £180k | £130k – £180k | £110k – £150k | £650 – £800 |

| Managing Director | £180k – £250k | £180k – £250k | £150k – £250k | £850 – £1k |

| Chief Credit Officer | £250k+ | £250k+ | £200k+ | £1k+ |

Corporate Investment Banking – Operational Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Graduate / Junior Analyst (0-12 mths) | £35k – £45k | £35k – £45k | £30k – £40k | £200 – £250 |

| Analyst (2-3 yrs) | £45k – £60k | £45k – £60k | £35k – £45k | £250 – £300 |

| Associate Vice President (3-6 yrs) | £60k – £80k | £60k – £80k | £45k – £70k | £300 – £400 |

| Vice President (6-9 yrs) | £80k – £115k | £80k – £115k | £70k – £90k | £450 – £550 |

| Executive Director / Senior Vice President (10+ yrs) | £110k – £145k | £110k – £145k | £80k – £100k | £600 – £800 |

| Head of Operational Risk / Managing Director | £160k+ | £150k+ | £100k+ | £800+ |

Private Banking – Operational Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Junior Analyst (0-12 mths) | £35k – £45k | £35k – £45k | £30k – £40k | £200 – £250 |

| Analyst (2-3 yrs) | £45k – £60k | £35k – £55k | £35k – £50k | £250 – £300 |

| Associate Vice President (3-6 yrs) | £60k – £80k | £45k – £70k | £45k – £70k | £300 – £400 |

| Vice President (6-9 yrs) | £75k – £110k | £70k – £90 | £70k – £90k | £450 – £550 |

| Director (9-12 yrs) | £100k – £145k | £80k – £100 | £80k – £100k | £600 – £800 |

| Head of Operational Risk | £140k+ | £100k+ | £100k+ | £800+ |

Asset Management – Operational Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Junior Associate (2-3 yrs) | £35k – £45k | £35k – £45k | £30k – £40k | £200 – £250 |

| Associate Vice President (3-6 yrs) | £55k – £80k | £55k – £80k | £40k – £65k | £250 – £400 |

| Vice President (6-9 yrs) | £70k – £95k | £70k – £95 | £60k – £80k | £400 – £500 |

| Director (9-12 yrs) | £75k – £120k | £75k – £120 | £70k – £100k | £500 – £700 |

| Head of Operational Risk | £110k+ | £110k+ | £100k+ | £700 – £900 |

Asset Management – Market/Investment Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Associate | £40k – £80k | £40k – £80k | £40k – £80k | £250 – £400 |

| Vice President | £75k – £130k | £75k – £130k | £75k – £130k | £400 – £650 |

| Director | £110k – £250k | £110k – £250k | £110k – £250k | £650 – £800 |

| Head of Investment Risk | £110k – £250k | £110k – £250k | £110k – £250k | £800 – £1,100 |

| Chief Risk Officer | £130k – £500k | £130k – £500k | £130k – £500k | £1,200+ |

Insurance – Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Associate | £40k – £80k | £40k – £80k | £40k – £80k | £250 – £400 |

| Vice President | £75k – £130k | £75k – £130k | £75k – £130k | £400 – £650 |

| Director | £110k – £250k | £110k – £250k | £110k – £250k | £650 – £800 |

| Head of Investment Risk | £110k – £250k | £110k – £250k | £110k – £250k | £800 – £1,100 |

| Chief Risk Officer | £130k – £500k | £130k – £500k | £130k – £500k | £1,200+ |

Retail Banking – Quant Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Graduate / Junior Analyst (0-12 mths) | £40k – £45k | £40k – £45k | £25k – £35k | £200 – £300 |

| Analyst (2-3 yrs) | £45k – £60k | £45k – £60k | £35k – £45k | £300 – £350 |

| Associate Vice President (3-6 yrs) | £65k – £90k | £60k – £80k | £45k – £65k | £350 – £500 |

| Vice President (6-9 yrs) | £90k – £125k | £90k – £110 | £65k – £90k | £550 – £700 |

| Director (9-12 yrs) | £125k – £180k | £120k – £180k | £90k – £150k | £750 – £1,000 |

| Managing Director | £180k+ | £180k+ | £150k+ | £1k+ |

Corporate Banking – Quant Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Graduate / Junior Analyst (0-12 mths) | £40k – £45k | £40k – £45k | £25k – £35k | £200 – £300 |

| Analyst (2-3 yrs) | £45k – £60k | £45k – £55k | £35k – £45k | £300 – £350 |

| Associate Vice President (3-6 yrs) | £65k – £85k | £60k – £80k | £45k – £65k | £350 – £500 |

| Vice President (6-9 yrs) | £90k – £130k | £90k – £110 | £65k – £90k | £550 – £750 |

| Director (9-12 yrs) | £130k – £190k | £120k – £180k | £90k – £150k | £800 – £1k+ |

| Managing Director | £190k+ | £180k+ | £150k+ | £1k+ |

Investment Banking – Quant Risk

| Area | London | South East | Regional | Contract day rate |

|---|---|---|---|---|

| Graduate / Junior Analyst (0-12 mths) | £50k – £55k | £40k – £45k | £25k – £35k | £200 – £300 |

| Analyst (2-3 yrs) | £55k – £65k | £45k – £55k | £35k – £45k | £300 – £350 |

| Associate Vice President (3-6 yrs) | £65k – £90k | £60k – £80k | £45k – £65k | £400 – £600 |

| Vice President (6-9 yrs) | £90k – £150k | £90k – £110 | £65k – £90k | £650 – £800 |

| Director (9-12 yrs) | £150k – £220k | £120k – £180k | £90k – £150k | £850 – £1,200 |

| Managing Director | £220k+ | £180k+ | £150k+ | £1,250+ |

Attract and retain the cyber security and data privacy professionals you need with Barclay Simpson.

View or Download PDF Version of the Report below:

If you are seeking a new role, please visit here to review current job opportunities, and if you wish to discuss the recruitment of risk or quant professionals, please contact us to set up a call with a specialist consultant.

Home

Home

Jobs

Jobs

Upload CV

Upload CV

Find Talent

Find Talent

Careers

Careers